Once Upon A Time Once Upon A Time - Plan Rules Unpacked

Have you ever found yourself in a situation where the rules of a plan, perhaps a retirement savings setup or something similar, felt like a story unfolding? It's almost like a tale, where each decision, each form, and every specific date plays a part in what happens next. Things can get a bit twisty, you know, when someone leaves a job or when financial arrangements shift.

It’s really about those moments when what seems like a simple step, like taking out a loan from a workplace plan, can turn into something quite different if circumstances change. We’re talking about the times when an employee’s path takes a new direction, and suddenly, what was straightforward becomes a puzzle with pieces that need careful placement. This sort of thing, well, it needs a good look, as a matter of fact.

Sometimes, the everyday happenings in a company, especially those connected to people's financial well-being, carry a surprising amount of detail. We'll explore some of these specific situations, looking at how different rules play out and what that means for everyone involved. It's about making sense of the details, you see, so that these stories have clear outcomes.

- Edith Vivian Patricia Upton

- Barrymore John Drew

- Rudolph The Red Nosed Reindeer 1964

- Karen Gillan Movies And Tv Shows

- Divergent Series Movies

Table of Contents

- What Happens When a Loan Goes Sideways?

- The Story of a Loan Default, once upon a time once upon a time

- How Do We Handle Account Holds?

- QDRO Procedures and Holds, once upon a time once upon a time

- When Do People Really Join a Plan?

- Figuring Out Entry Dates, once upon a time once upon a time

- Can a Plan Refuse a Beneficiary Choice?

- Beneficiary Rules and QDROs, once upon a time once upon a time

What Happens When a Loan Goes Sideways?

Imagine, if you will, a situation where an employee, someone who was working for a company, decided to take out a loan. This loan, it seems, was for a big purchase, their primary home. Now, for whatever reason, this person stopped working for the company. When that happened, the loan they had, well, it wasn't paid back as planned. This kind of event, as a matter of fact, brings up some interesting points about how plans work.

When a loan like this isn't paid back, especially after someone stops working, it often gets treated in a specific way. It's considered something called a 'deemed distribution.' This means, in a way, that the money from the loan is now seen as if it were paid out from the plan, even though it wasn't a direct cash payment at that moment. This sort of thing, too, has particular consequences.

So, when a loan becomes a 'deemed distribution,' there's a document that usually comes into play. This document is known as a 1099r. It's basically a tax form that shows this particular type of payment or distribution. It's how the tax folks get the information they need about what happened with the money. This process, you know, follows a set of rules.

- Jack Donoghue

- King Charles Age

- Ashley Benson And

- Johnson Family Vacation Cast

- Michael Chiklis Movies And Tv Shows

The whole idea of a loan from a retirement plan is that it's supposed to be paid back. When that doesn't happen, and the person is no longer working there, the plan has to account for that money somehow. That's where the 'deemed distribution' part comes in. It's a way of saying, in effect, that the money has left the plan's care for tax purposes. This is, you know, a pretty standard way to handle these things.

The Story of a Loan Default, once upon a time once upon a time

Once upon a time once upon a time, an employee's financial arrangement with their company's plan took an unexpected turn. When someone stops working, and they have an outstanding loan from their workplace savings plan, especially one used for something like buying a house, things can get a little complicated. The plan needs a way to handle that unpaid balance. It's really about how the system accounts for what happened.

The process of calling that unpaid loan a 'deemed distribution' is, in a way, a formal step. It's how the plan marks that money as having been 'taken out' for tax reporting, even if no cash was physically handed over at that point. It's a technical way of saying the loan went bad, and the money is now considered part of the person's income for that year. This, you see, has tax implications for the individual.

Issuing a 1099r form, then, becomes a necessary part of this story. This paper lets the tax authorities know about the 'deemed distribution.' It's a record, essentially, of what happened with the loan. This is how the plan, more or less, closes the book on that particular loan for that person. It's a way of making sure everything is properly reported.

So, the story of a loan default, in this setting, isn't just about someone not paying back money. It's about how the plan itself responds, following specific rules to make sure everything is on the up and up from a tax and reporting point of view. It's a clear process for handling these situations.

How Do We Handle Account Holds?

Sometimes, there's a need to put a hold on a person's account within a plan. This often comes up when there are specific legal orders, like a Qualified Domestic Relations Order, or QDRO. People often wonder where they can find good information about the best ways to go about this. It's a bit of a specific area, so finding reliable guidance is important.

When a QDRO comes into play, it usually means there's a legal division of retirement benefits, often due to a divorce or separation. Placing a hold on the account helps make sure that the money stays put until the details of the QDRO are sorted out and put into action. This prevents any unintended withdrawals or movements of funds while things are being decided. It's a protective measure, really.

Folks who work with these kinds of plans are often looking for advice on what are considered the top ways to manage these QDRO procedures. They want to make sure they're doing things correctly, following all the steps to place that hold effectively. It's about getting it right, you know, so that the legal order is properly carried out.

There's a good deal of interest in finding out what are considered the most effective methods for handling these account holds. This means looking for established ways of doing things, perhaps shared experiences or guidelines that have proven helpful for others in similar roles. It's about learning from what has worked well.

QDRO Procedures and Holds, once upon a time once upon a time

Once upon a time once upon a time, the need arose to secure a person's plan account, often because of a legal order. The idea of placing a hold on a participant's account as part of QDRO procedures is something many people want to understand better. They're curious about where to find information that lays out the best ways to do this, the most effective steps to take.

It's about making sure that when a QDRO is received, the plan administrator knows how to put that temporary stop on the account. This ensures that the funds involved in the legal order are protected and can't be moved or accessed until the terms of the QDRO are fully implemented. This is, you know, a very important part of the process.

Finding good information about these practices means looking for clear steps and common approaches that have been used successfully. It's about understanding the specific actions to take to make sure the account hold is put in place correctly and doesn't cause any problems down the line. This is, in a way, about following established protocols.

So, when it comes to QDRO procedures and putting a hold on an account, the goal is really to find those tried-and-true methods. It’s about making sure the plan handles these sensitive situations with care and precision, protecting the assets as required by the legal order. This helps keep everything running smoothly.

When Do People Really Join a Plan?

A common question involves when someone actually gets to join a plan. It often depends on how many hours they've worked. For instance, if you've figured out that a person has worked 1,000 hours within a 12-month period, what happens next? What are the specific dates when they can actually become part of the plan? This is, you know, a pretty common thing to sort out.

Many plans have specific entry dates. You might see dates like January 1st and July 1st. So, if someone meets the hour requirement, say, sometime in the middle of a year, they might not get to join right away. They would have to wait until the next available entry date. This means there's a bit of a waiting period, more or less, for some folks.

For example, if a plan's entry dates are January 1st and July 1st, and someone meets their 1,000 hours in, say, August of 2022, they wouldn't enter the plan until January 1st of 2023. This is how the rules are often set up. It’s about making sure everyone joins at specific, predetermined times.

This system of entry dates helps plans manage new participants in a structured way. It keeps things organized, rather than having people join at random times throughout the year. It's a way of setting clear milestones for participation. This is, in a way, about fairness and predictability for everyone involved.

Figuring Out Entry Dates, once upon a time once upon a time

Once upon a time once upon a time, a question arose about when a person could truly become a part of the company's savings plan. After determining that someone has worked a thousand hours in a twelve-month stretch, the next step is to figure out the plan's official entry dates. These are the specific times when new people can actually start participating.

Consider a situation where the entry dates are set for the first day of January and the first day of July. If a person meets their hour requirement, say, in the fall of a given year, they don't simply join right then. They'll need to wait for the next official entry point. So, if they met the requirement in 2022, they might not get into the plan until January 1st, 2023. This is just how it works, you know.

This system ensures that everyone who becomes eligible waits for a set time to join. It provides a clear schedule for adding new participants, making the administration of the plan a bit more straightforward. It's about having a predictable rhythm for welcoming new members.

So, figuring out entry dates is a key part of how these plans operate. It ensures that once a person has met the initial work requirement, they know exactly when their official participation can begin. It's a way of making sure everything is clear for everyone.

Can a Plan Refuse a Beneficiary Choice?

It's an interesting point that sometimes, in QDROs, there's a specific instruction that says an alternate payee, the person receiving a share of the benefits, can't name a new spouse as a beneficiary. This brings up a question: can a plan actually say no to this kind of rule? Can they refuse to allow such a restriction, and instead, permit the alternate payee to name whoever they wish? This is, you know, a fairly specific point of contention.

QDROs are legal documents, and they often contain very particular instructions about how benefits should be paid out and who can receive them. When a QDRO tries to limit who an alternate payee can name as a beneficiary, it touches on the plan's own rules and how much control it has over those designations. It’s about where the lines are drawn.

The plan has its own set of rules, its own document, that governs how it operates. The question then becomes whether the plan's existing rules or broader legal frameworks would allow it to override a specific instruction within a QDRO. It's a matter of legal interpretation and compliance. This sort of thing, well, it needs careful consideration.

So, whether a plan can refuse to allow a QDRO to prohibit an alternate payee from naming a new spouse as a beneficiary is a matter of checking the plan's own provisions and relevant laws. It's about understanding the hierarchy of rules and what the plan is legally obligated or permitted to do.

The Once Upon A Time Family Tree Explained

Once Upon a Time. Finding Disney in “Once Upon a Time”… and Why You

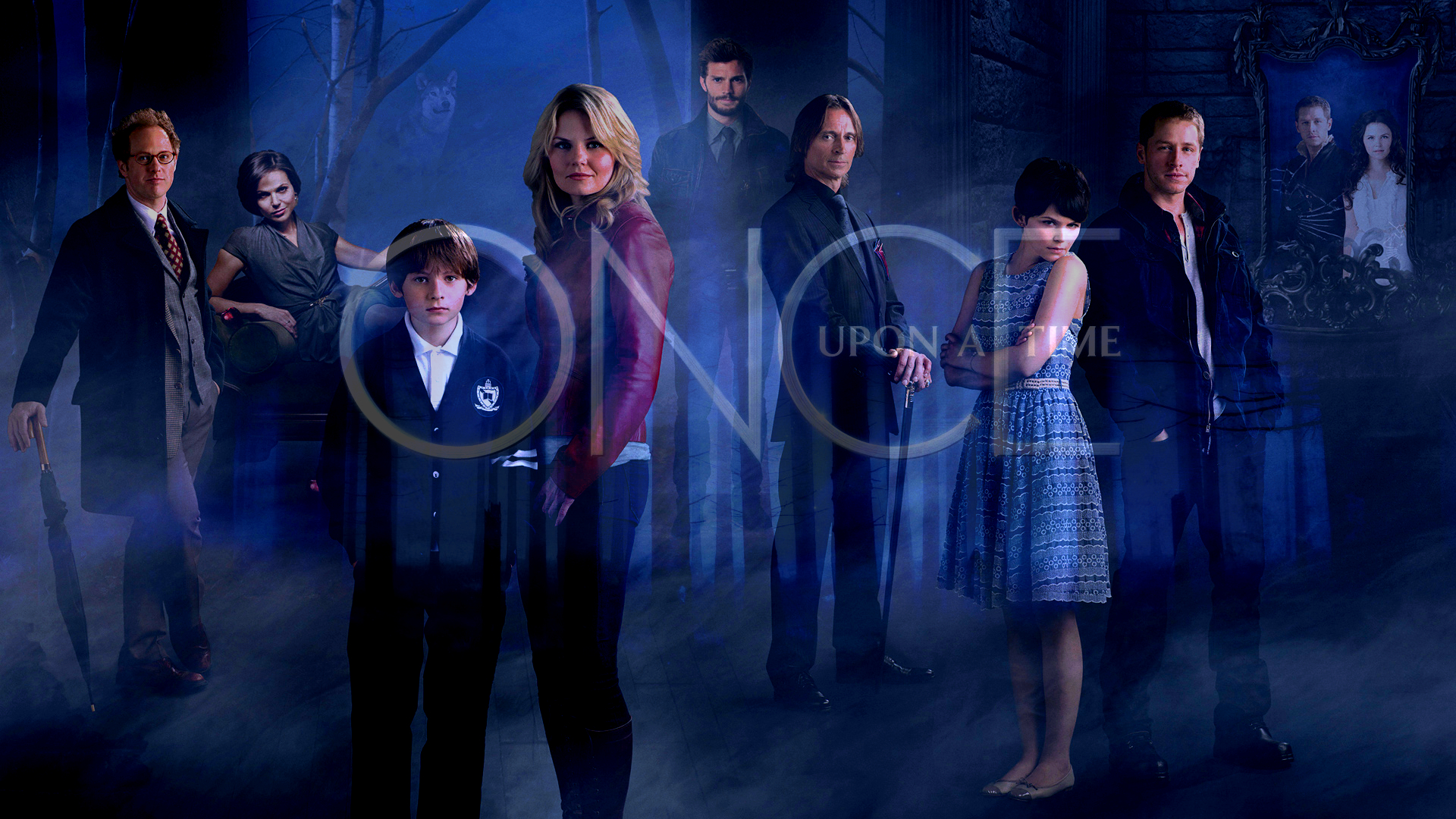

Once Upon A Time - Once Upon A Time Wallpaper (28309802) - Fanpop